In a concerted effort to match up to China’s burgeoning shipbuilding capability, the United States is courting its Asian allies, Japan and South Korea, to help it restart redundant shipyards.

The US approach focuses on tapping Asian funding, engineering know-how, and shipbuilding experience to expand its shipbuilding capacity, Nikkeia Asia reported.

US Secretary of the Navy, Carlos Del Toro, made pitches to join initiatives to resurrect shuttered shipyards in the United States during his visits to two shipyards in South Korea and one in Japan last week.

US Ambassador to Japan Rahm Emanuel, who accompanied Del Toro to the Mitsubishi Heavy Industries shipyard in Yokohama last week, stated that the visit served two purposes: to examine the repairs made to the fleet replenishment oiler USNS Big Horn and to determine whether the Japanese company would be interested in investing in a closed US shipyard.

Emanuel said, “There’s a closed plant in Philadelphia. There’s a closed Navy shipyard in Long Beach. And there are a couple of others…We wanted to see if Mitsubishi and other Japanese companies would be interested in potentially investing and reopening one of those shipyards and being part of building Navy, commercial, and Coast Guard ships.”

The development follows Del Toro’s announcement last month that he would visit South Korea and Japan to promote investment in shipbuilding, particularly in smaller yards.

Emanuel had also hinted in January this year that for US Navy warships to remain in Asian waters and be prepared for any future confrontation, the United States and Japan are attempting to reach an agreement enabling Japanese shipyards to do routine maintenance and overhauls.

Over the past 40 years, China has developed a remarkable commercial shipbuilding industry, cautioned Del Toro at an event. “We’ve lost that capability from about the 1980s when we left it open to market forces.”

The move comes at a time when there is widespread concern in the US about reduced capacity caused by delays and cost overruns for several major military programs, including the construction of submarines and aircraft carriers.

Reports from May 2023 indicated that the US Navy was exploring the possibility of using private shipyards in Japan to maintain, repair, and refurbish its warships to cut down on local servicing backlogs. At that time, it was speculated that the effort would expand to include Singapore, South Korea, and the Philippines.

It was a pleasure to meet Japan Defense Minister @kihara_minoru during my third visit to Japan as Secretary of the Navy. The U.S.-Japan Alliance is the cornerstone of peace, security, and prosperity in the Indo-Pacific region and beyond. (1 of 2) pic.twitter.com/kkwE5Uj2vR

— Secretary of the Navy Carlos Del Toro (@SECNAV) February 28, 2024

After his recent visit to Mitsubishi, Emanuel said he was in favor of using private shipyards in Japan to maintain, repair, and refurbish American warships. Ships stationed in Japan would be included initially, but later, ships in US ports would also be included.

“It keeps ships in theater so that we don’t lose time on the travel back and forth from the United States when it comes to repair work. The repair work being done here would relieve pressure on American shipyards, so they are building new ships,” Del Toro said.

Besides Japan, another major US ally, South Korea, is also being tapped for similar collaboration. Del Toro traveled to the southern tip of the Korean Peninsula to tour the shipyards of Hanwha Ocean on Geoje Island and Hyundai Heavy Industries in Ulsan, which is the largest shipyard in the world.

United States Secretary of the Navy, Carlos Del Toro visited Korean major shipbuilders and shipyards for MRO(Maintenance, Repair and Overhaul) business exploration.

He visited HD Hyundai Heavy Industries and Hanwha Ocean.

Each shipyards house next generation Aegis… pic.twitter.com/Mtyu5WHSYd— ハク Mason (@mason_8718) February 28, 2024

Del Toro told the industry leaders: “There are numerous former shipyard sites around the (the US) which are largely intact and dormant. These are ripe for redevelopment as dual-use construction facilities for both warships, like Aegis destroyers, as well as high-value chain commercial vessels, such as the ammonia gas carriers, that will enable the global transition from fossil fuels to green energy sources like hydrogen.

“Investment in dual-use shipyards in the United States will create good-paying, blue-collar and new-collar American jobs building the advanced ships that will protect and power the economy of tomorrow.”

The US has seen a very significant dip in its shipbuilding capacity. Nine of the 13 public naval shipyards the United States formerly had are closed. Several closed shipyards are now national parks, naval air stations, or container terminals. However, a few could be brought back for ship repair or construction.

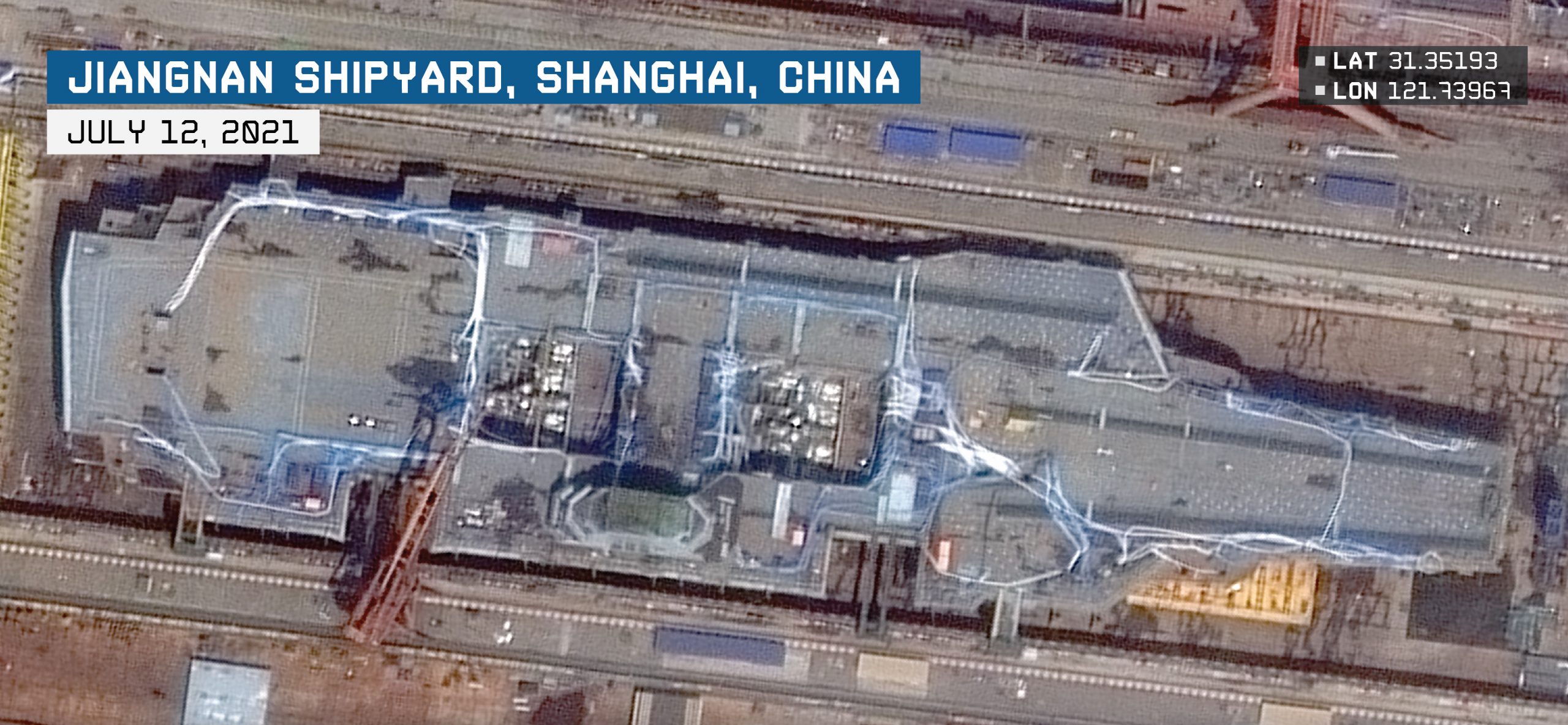

The urgency to resuscitate these redundant shipyards stems from the threat posed by China’s massive shipbuilding industry, producing many naval vessels that could be used to project dominance in far seas and deployed against the US and its Indo-Pacific allies in the event of a conflict.

China’s Shipbuilding Capability Spurs Urgent US Action

The world’s largest Navy, China’s People’s Liberation Army-Navy (PLA-N), has been expanding rapidly, surpassing the United States in shipbuilding capacity. The PLA-N’s induction of warships proceeds at the speed of “dumping dumplings into soup broth,” as the common saying goes.

A leaked US Navy Intelligence presentation slide revealed last year that the Chinese shipyards could build ships at a whopping 232 times faster than the US. Chinese shipyards can build over 23.2 million tons, while US shipyards can only create fewer than 100,000 tons.

The slide also showed the “battle force composition” of the two navies against each other, which included “combatant ships, submarines, mine warfare ships, major amphibious ships, and large combat support auxiliary ships.”

China’s fleet now possesses more warships than the US did at some point between 2015 and 2020, and the difference between the two navies is rapidly widening.

According to the latest Pentagon’s annual report to Congress on Chinese military and security developments, the Chinese Navy possesses an estimated 350 vessels, while the US Navy battle force has 293 warships.

The yawning gap of 60 hulls between the two navies is expected to grow every five years until 2035, when China will have an estimated 475 naval ships compared to 305-317 US warships. Notably, China has inducted as many as 150 warships in the last ten years.

The Chinese Navy possesses not just battleships but also coast guard and marine militia forces. Even by cautious estimates, the combined number of ships in all these maritime fleets exceeds 700, making them the largest in the world.

The US Congressional Budget Office stated in a November 2022 report that the US fleet is anticipated to shrink as older ships are decommissioned.

The US Navy leadership has advocated for a fleet of about 380 ships in the future. However, the rate of building does not look promising. The biggest backlog is in nuclear-powered submarines, which are regarded as one of the few areas in which the United States is recognized to have a clear advantage over the People’s Liberation Army Navy of China.

It is believed that by bringing in more financial and human resources from Asia, the United States will be able to somewhat bridge the gap with China’s shipbuilding prowess and spur the construction of vessels required for force projection.

- Contact the author at sakshi.tiwari9555 (at) gmail.com

- Follow EurAsian Times on Google News