Japan’s new export restrictions on chip-related equipment and materials are believed to be aimed at scuttling China’s semiconductor self-sufficiency plan, following similar restrictions imposed by the US and the Netherlands.

Taiwan Will Not Be Another Ukraine Despite China’s Military Superiority; India Can Play A Critical Role

Japan announced in March this year that it will tighten regulations on exporting 23 types of advanced semiconductor production equipment, harming its long-time adversary where it will hurt the most amid recent sprawling tensions in the Indo-Pacific.

The new export restrictions are set to come into force from July.

According to sources in the industry, these regulations have been introduced to derail China’s semiconductor industry since the selected items are critical and have accordingly been targeted, Hong Kong-based South China Morning Post noted.

According to insiders and a list seen by the publication, the measures call for special authorization to export 23 different commodities to any nation that isn’t on a list of 42 “friendly” markets. It would be a de facto embargo for China, comparable to US export restrictions proposed in October 2022, inflicting severe damage to Beijing’s efforts to increase semiconductor self-sufficiency.

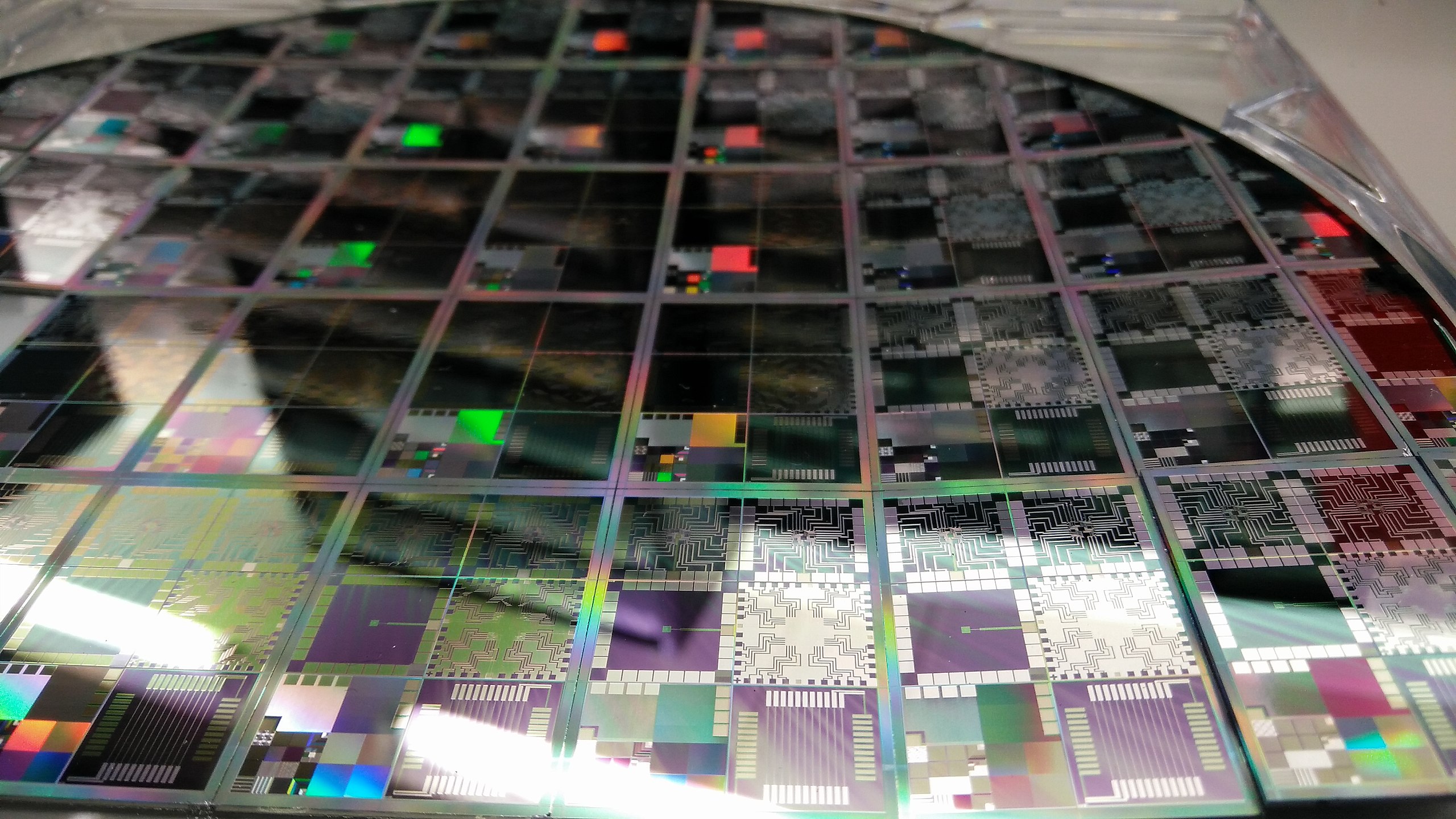

Semiconductors, an essential component of almost all electronic devices, have become a significant battleground in the dispute between Washington and Beijing over access to critical technology.

President Xi Jinping’s administration views the chips (found in everything from phones to fighter jets to home appliances) as essential tools in its struggle for wealth and power on a global scale as well as in its strategic conflict with the United States. A Chinese scientist claimed in February that chips are at the center of a “technology war.”

The Chinese commerce minister urged Japan to lift the rules last month, warning that they would impact bilateral trade and economic ties. However, there are few signs that the decision would be suspended or overturned.

On June 2, days after Japan finalized the decision, Chinese Ambassador to Japan Wu Jianghao stated that Japan’s willingness to set limits on China-Japan semiconductor cooperation would lead to a lose-lose situation for the two countries, leaving the US as the “sole winner.”

After automobiles, semiconductors are Japan’s second-largest export and are its main export to China. Wu warned Japan that if the country insists on restricting China-Japan semiconductor collaboration, it would not only lose the sizable Chinese market but also jeopardize the semiconductor industry’s future and Japan’s commercial reputation.

The development comes amid rising tensions and disenchantment between Beijing and Tokyo recently, especially after alleged Chinese aggression in the Taiwan Strait.

Faced with a constant military threat from its regional adversaries, which includes China, Japan has gone on a military modernization spree, further inviting China’s ire. Tokyo is reportedly doubling its defense spending to 2% of its GDP and procuring missiles that can strike ships or land-based targets 1,000 kilometers (600 miles) away.

However, restricting the export of semiconductor chips to China would likely pose a threat without firing a shot.

The extensive list of prohibited items includes various high-tech tools and supplies required to fabricate sophisticated chips. According to the list seen by SCMP, specific deep ultraviolet (DUV) lithography tools that print chips on wafers using a 193nm light source and can advance chip-making technology to 14nm are being targeted.

An unknown chip investor told SCMP, “My feeling is that the list is intended to plug all the alternative procurement sources from Japan where Chinese companies could turn to.” He said the limitations might be “devastating” for China’s chip manufacturing sector, which is already having trouble due to US sanctions.

The Politics Of Semiconductor Chips

Amid rising tensions between the two bitter rivals, the United States introduced export control measures for semiconductor chips aimed at China in October 2022. The Biden administration said the decision was rooted in the urgency to minimize the harm to the American chip industry.

“We recognize that the unilateral controls we’re putting into place tomorrow will lose effectiveness over time if other countries don’t join us, and we risk harming US technology leadership if foreign competitors are not subject to similar controls,” said a senior administration official who spoke on the condition of anonymity at the time.

However, the US restrictions have been in place since the time of Donald Trump’s administration. According to industry analysts, during the past three years, to reduce US parts usage in Chinese fabs, Chinese chipmakers have turned to non-American suppliers, primarily from Japan, the Netherlands, and Germany.

However, in March this year, the Dutch government announced it was planning new restrictions on semiconductor technology exports to protect national security, joining the US effort to curb chip exports to China.

In a letter to parliament, Dutch Trade Minister Liesje Schreinemacher announced that the limits would be implemented before the summer.

She didn’t mention China, a significant trade partner of the Netherlands. Like the recent Japanese ban, the Dutch also said the “DUV” lithography systems, the second-most sophisticated equipment that their biggest supplier ASML sells to companies that make computer chips.

With Japan now following in similar footsteps, matters will likely become more complicated for China’s technology sector. Even though China has its chip foundries, they only provide the low-end processors used in automobiles and home appliances.

Beginning with then-President Donald Trump, the US government has been restricting access to an expanding range of equipment used to produce chips for advanced applications like AI and server-side computing. Japan and the Netherlands have joined the effort to restrict access to technologies they believe could be used to create weapons.

In response, the China Semiconductor Industry Association (CSIA) said Japan’s export control measures “would bring even greater uncertainty to the ecosystem of the global semiconductor industry, and the CSIA opposes the act of interfering with global trade liberalization, distorting global supply and demand balance.”

- Contact the author at sakshi.tiwari9555 (at) gmail.com

- Follow EurAsian Times on Google News